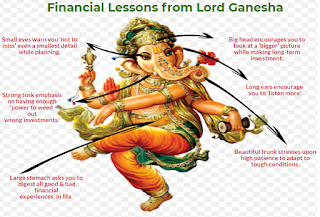

This Ganesh Festival Follow These 5 Major Financial Lessons for a Better Future!

The 10-day long festival of

Ganesha is considered the time for prosperity and success. The arrival of

Ganesha brings you joy, but do you know that it also teaches you about your

financial and credit life? Here are 5 major lessons you should learn from this

festival.

·

Begin today to

create a long credit history

Lord Ganesha is the God of new beginnings. Let the arrival

of Ganesha inspire you to start your journey towards building a strong credit

life. A credit score

of 750+ brings great benefits in your financial life. Loans are easily

approved, you are eligible for best credit cards, and you can also negotiate

loan terms with the lenders. All these advantages make it easy for you to take

financial decisions.

Well, a good credit score is a part of your credit

history. The longer the history, the better is your score. With a high score,

lenders consider you a responsible borrower and you can get loans easily. If you are looking at building your credit

history, apply for a credit card. Ensure, you use it wisely, pay your monthly

credit card bills on time.

· Inculcate a

credit discipline

Ganesh Chaturthi is a festival where the preparations

begin at least a month in advance. Right from the arrival of Ganesha till the

day of immersion, every day and every step is carefully planned and executed.

Like these preparations, preparations for building a credit score also requires

proper due diligence and a disciplined approach. For

instance, if you don’t pay your loan EMIs and credit card dues on time, your

credit score will be hampered.To ensure a good credit score, you need to follow

certain rules like paying your credit card dues on time, clearing your debt

fast, and not exceeding your credit limit.

·

Create a budget

for yourself

Organizing such a great festival requires chalking out a

budget keeping in mind your spending capacity. The same applies to your credit

usage too. For instance, if you plan to use your credit card to pay for your

monthly expenses, you need to use your card within the credit limit provided to

you. Stick to 30-40% of your credit limit; exceeding this percentage can have a

negative impact on your credit score. Also, exceeding your credit limit is

considered as a 'credit hungry' behavior by the lenders, and they may not grant

you a loan. Use credit cards as per your paying capacity. Having multiple cards

and not repaying on time can again affect your score. Create a budget for

yourself so that you can use your credit wisely.

·

Keep an eye on

every small detail:

During this festival, you want everything to be perfect.

You arrange for fresh flowers, colorful lightings, delicious sweets, and are

prepared for guests who will join the celebrations. You pay attention to every

little detail pertaining to the festivities. Your credit report too needs special attention. You should avail

your free credit report by CRIF every year and

review it thoroughly. CRIF High Mark is one of the four RBI recognised credit information companies in India. Any wrong information can affect

your score. So, monitor your report regularly to ensure all the information is

correct and up to date.

·

Preparing feast

and prasad for ultimate satisfaction

Having ‘Modak’, the

favourite dessert of Lord Ganesha makes you feel happy, doesn’t it? You feel

that Lord Ganesha has blessed you for the hard work you've put to celebrate

this festival. Similarly, when you’ll follow the financial and credit lessons,

you get your own credit rewards in terms of an excellent credit score. With a

credit score of 750+, lenders will easily approve your loan and extend your

credit limit.

So, now that

you have learnt the financial and credit lessons from one of the most joyful

festivals, Ganesh Chaturthi, implement them in your credit life and create a

strong credit score.

Comments

Post a Comment